PwC’s latest survey has revealed that corporate leaders plan to focus on workplace safety and staff health, despite profit losses, as US states consider gradually lifting COVID-19 lockdown restrictions across the nation. Cost containment measures – as well as financial cuts – to survive the crisis, however, will be inevitable, according to the global firm.

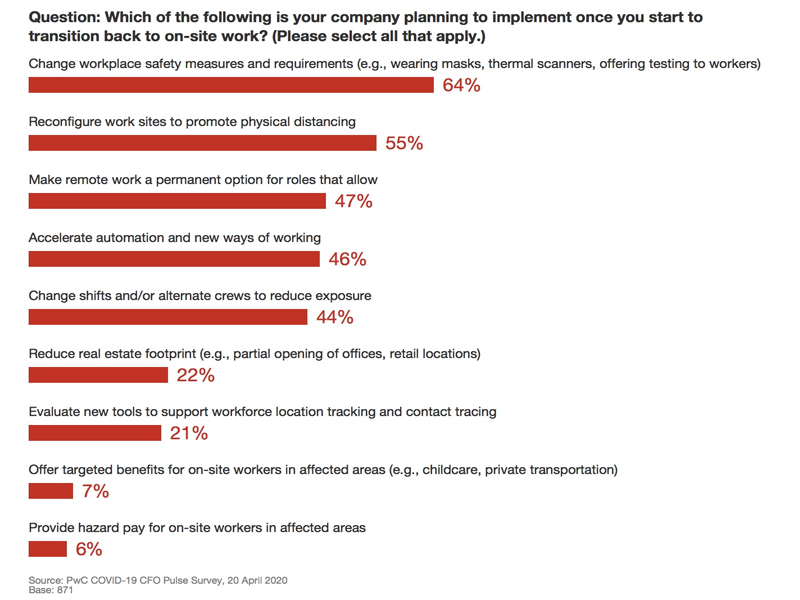

PwC’s COVID-19 CFO Pulse Survey reveals that 77% of US chief financial officers (CFOs) anticipate changing workplace safety measures upon returning to on-site work. As employers focus on protecting employees, 65% anticipate reconfiguring work sites to promote physical distancing and 52% anticipate changing and/or alternating shifts to reduce exposure. In addition, half expect a higher demand for employee protection.

As states start to lift stay-at-home orders and reopen local economies, 52% of CFO said their businesses could return to normal in less than three months if COVID-19 were to end immediately. Increasingly, business leaders are considering layoffs as they look to contain costs in the face of an ongoing pandemic. According to the survey, 32% of CFOs are now anticipating layoffs, up 6 points from two weeks ago, and more than half (53%) said they are projecting revenue/profit losses to be greater than 10% this year.

PRIORITISING STAFF SAFETY

“As some states look to reopen, business leaders are recognising they not only play a crucial role in the health, safety and stability of their employees, but also that of their communities,” said Tim Ryan, PwC’s US Chair and Senior Partner. “As we continue to navigate this crisis, I’m encouraged to see that despite difficult decisions and potential profit losses, business leaders are continuing to do what they can to put their people first and, in turn, help support local communities and economies as the nation looks to rebound.”

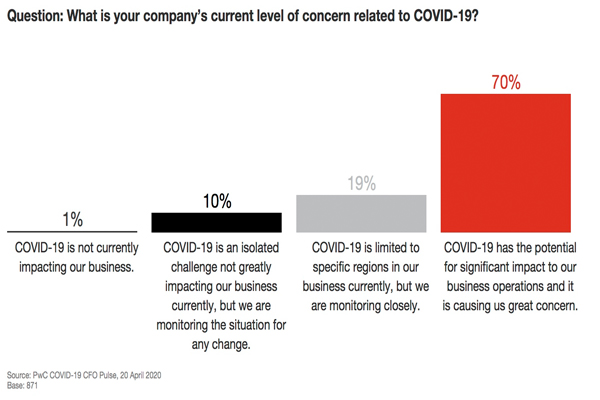

Nevertheless, many organisations across practically all industries across all states have been affected by the Covid-19 crisis, with 70% of CFOs highly concerned about the “significant impact” on business operations. Only 1% of CFOs claim that COVID-19 has not affected their business.

REMOTE WORK A PERMANENT OPTION

On a positive note, PwC data reveals that around half (49%) anticipate making remote work a permanent option for roles that can accommodate it. However, around a quarter of CFOs (22%) indicated plans to implement contact tracing as part of their strategy to reopen their workplaces.

“While business leaders begin to forge strategies to bring employees back into the workplace and to engage with their customers in person, they are realizing that the physical workplace and customer experience will be drastically different from before the COVID-19 pandemic,” added Amity Millhiser, PwC’s Chief Clients Officer. “Many of them are turning to new technologies and digital solutions to help them adapt and maintain social distancing, which will likely be a new normal for the foreseeable future.”

As businesses move toward a return to the workplace, PwC has created a Check-In with Automatic Contact Tracing – a tool that allows companies to help quickly identify and alert employees who may have come into contact with a co-worker at the workplace who has tested positive for COVID-19.

FINANCIAL IMPACT & POTENTIAL CUTS

According to the survey, 71% of CFOs indicated that the financial impact remains a top concern. Around 80% of respondents expect that COVID-19 will decrease their company’s revenue and/or profits this year, while 5% of respondents expect a decrease in revenues of over 50%. However, 12% report that COVID-19’s impact on revenue and/or profits is still too difficult to assess at present.

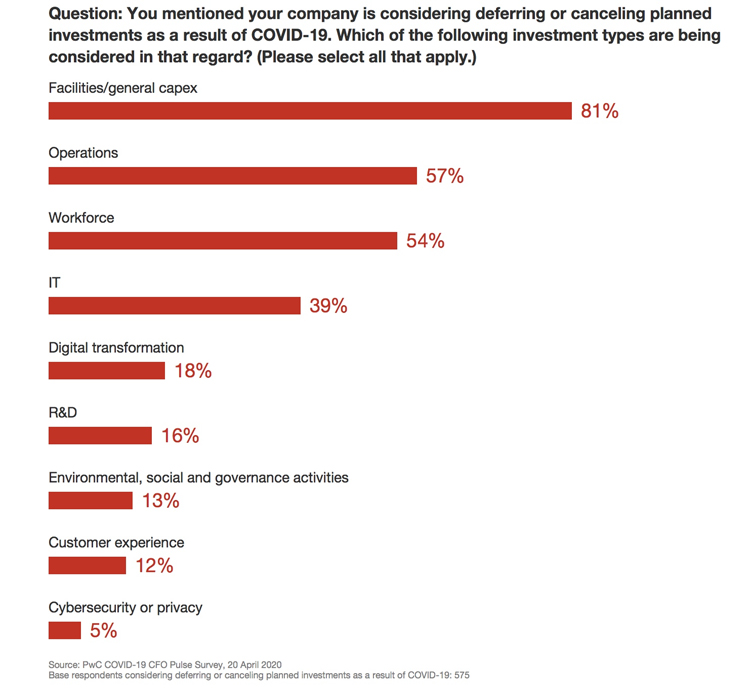

As a result, many firms will have no choice but to consider cost containment measures, as well as cost cuts. Around 86% of CFOs are considering implementing cost containment, with 70% contemplating deferring or cancelling planned investments. Of these CFOs, 80% are considering delaying or cancelling facilities/general CapEx, whereas 62% are contemplating workforce cuts and 48% are considering decreasing IT spend.

Click here to access the full survey results.