S&P Global Market Intelligence’s latest survey has revealed that two-thirds of businesses plan to keep homeworking policies post Covid-19. Many also plan to reduce office space by at least 25%. Almost 80% of organisations surveyed said they have implemented or expanded universal work-from-home policies as a result of COVID-19, with 67% expecting these policies to remain in place either permanently or for the long-term.

Enterprises around the world are quickly learning how to adapt to a new normal in the wake of disruptions caused by COVID-19, according to a recent survey conducted by S&P Global Market Intelligence’s technology research unit 451 Research. “As organisations are heading back to the office in the wake of COVID-19, it is important to quantify what changes materialised during these past few months as a potential indication for the future of work,” stated Liam Eagle, Head of Voice of the Enterprise Research at 451 Research, part of S&P Global Market Intelligence. “Leveraging timely data from our flash survey capabilities can help us better understand these changes and overall market sentiment, while enabling organisations to make informed business decisions during times of uncertainty.”

The survey carried out between May 29 to June 11 from approximately 575 IT decision-makers across a range of industries, sheds light on the future of work and highlights some of the enterprise-wide changes that companies actually experienced or implemented from changes to budgets to how enterprises plan to return to the office.

NO RUSH BACK

In addition to the 80% of organisations having employed/expanded work-from-home policies, 85% have implemented travel limitations and the same percentage have limited or banned face-to-face meetings. Approximately, 71% also said they are converting hosted events into virtual ones and 37% have expanded employee leave rules amongst other changes.

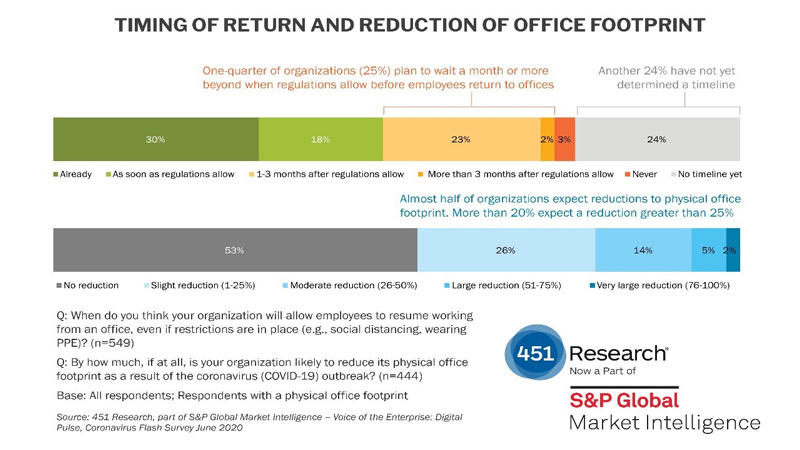

Companies are in no rush for staff to head back to the workplace, according to S&P Global’s findings. Although almost 19% of organisations intend to have employees return to offices as soon as local regulations allow, 25% will wait a month or more, while another 24% have not yet determined any timeline. A reduction in office space is also expected. While companies are hesitating to head back to physical office spaces, 47% of respondents say they are likely to reduce its physical office footprint because of the COVID-19 outbreak. More than 20% expect office space to be reduced by more than 25%.

Altered working conditions are presumed to be long-term or permanent. About 20% say their organisation is planning to operate under alternate conditions such as remote working, wearing protective gear, and social distancing through 2021 and beyond. Around 14% believe that conditions have been altered permanently, while 18% have yet to establish a plan. Travel will remain scarce, even in Q4 2020. Compared to the last quarter of 2019, a third of organisations (34%) expect work travel to be reduced by 80% or more in the fourth quarter of this year; yet, a large cohort of respondents (21%) say they don’t know how much travel will resume during this period.

OTHER KEY FINDINGS

The main barrier to returning to office life is social distancing, according to the survey. Around 79% of firms agree that social distancing will be the biggest challenge in resuming normal operations. Organisations are more likely to be spending more on IT resources with notable increases to security spending. Compared to March, increased information security spending grew more common (from 15% to 28% of businesses) with firms spending more on communication and collaboration technologies (50%), employee devices and services (43%), information security tools (42%) and network capacity (38%).

Finally, many businesses are seeking flexible terms from suppliers. More than half (56%) of organisations agreed they were offering to adjust the terms of leases, licenses or contracts for their customers. Similarly, 42% of firms said they were expecting or asking IT vendors to adjust pricing, payment terms or payment models.

S&P’s Global findings echo the results of a survey carried out by RW3 CultureWizard, as reported.