New research has highlighted the significant impact of the spiralling cost of living crisis on employees’ home and work life; driving them to change jobs, take on more hours, and even attend work when they should be off sick.

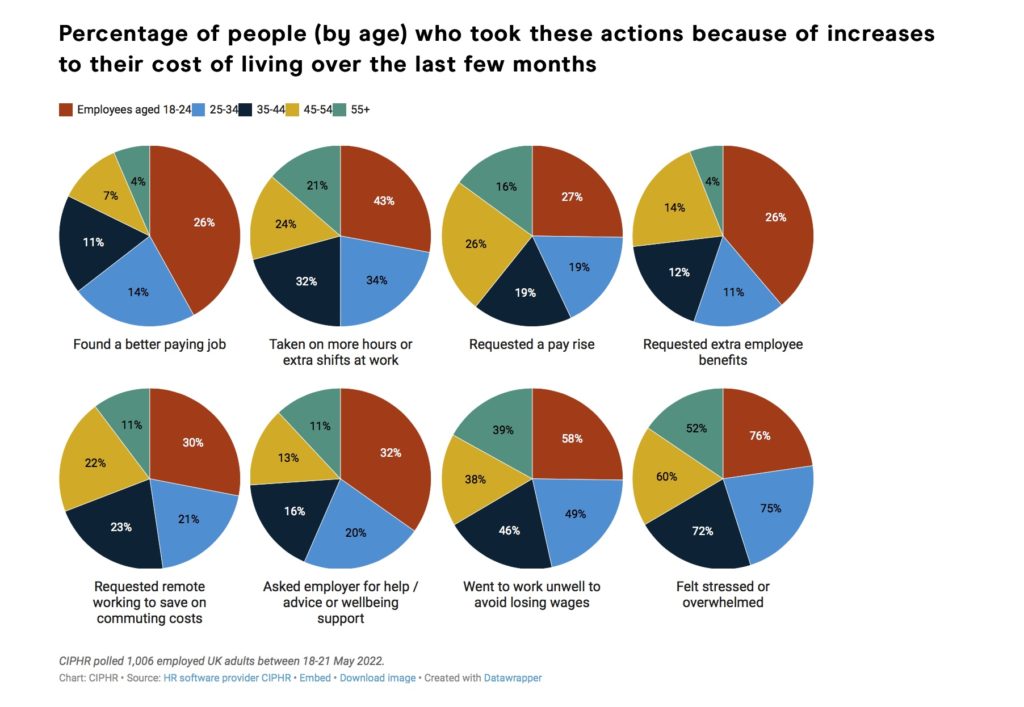

Nearly one in three (31%) of the 1,006 UK-based workers polled by HR software provider CIPHR, are working more hours or extra shifts because of rising living costs over the last few months; and one in eight (12%) have taken on an additional job.

One in four (26%) men and one in five (18%) women say they’ve requested a pay rise to help offset record inflation. A further 12% (16% of men and 10% of women) have asked their employer to expand their employee benefits package, by, for example, adding a health cashback plan or an employee discounts scheme.

COST OF LIVING CRISIS

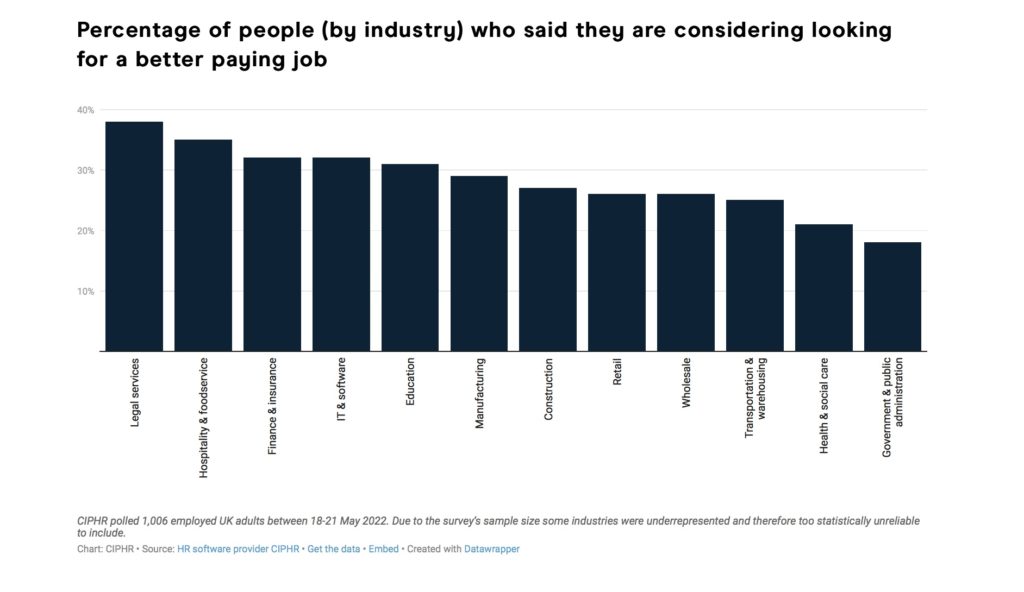

Many, however, are looking elsewhere to boost their earnings. One in eight (12%) people claim to have already found alternative employment with higher wages. Over double that number (27%) are considering doing the same; finding a job with better pay because of cost of living increases. Legal professionals (38%) and hospitality workers (35%) are statistically the most likely to change jobs for more money; followed by workers in finance (32%), IT (32%) and education (31%).

While it’s impossible to quantify the full effects of the ongoing cost of living crisis on an individual’s health and wellbeing, CIPHR’s research reveals that two in three people (68%) admit to feeling stressed or overwhelmed at times because of it. Women are more likely than men to say they feel this way (74% compared to 61%). Younger workers also appear to be more affected than other age groups, with 76% of 18-to-34-year-olds, compared to 57% of people over 45, saying that cost of living increases have caused them to experience stress or feel overwhelmed.

This mirrors recent findings from the Office for National Statistics’ latest opinions and lifestyle, released earlier this month, which showed that 77% of people felt very or somewhat worried about the rising cost of living.

RESPONSE TO RISING COST OF LIVING

Reducing household spending – something that 67% of CIPHR’s survey respondents say they’ve already done – unfortunately only goes so far. Around 70% of workers with children and 64% of workers with no children have made changes to their expenditure, as a result of rising living costs. Other decisions that people have taken in response to spiralling living costs include requesting remote working to save money on petrol or commuting costs (21%), and asking employers for help and advice or wellbeing support (18%).

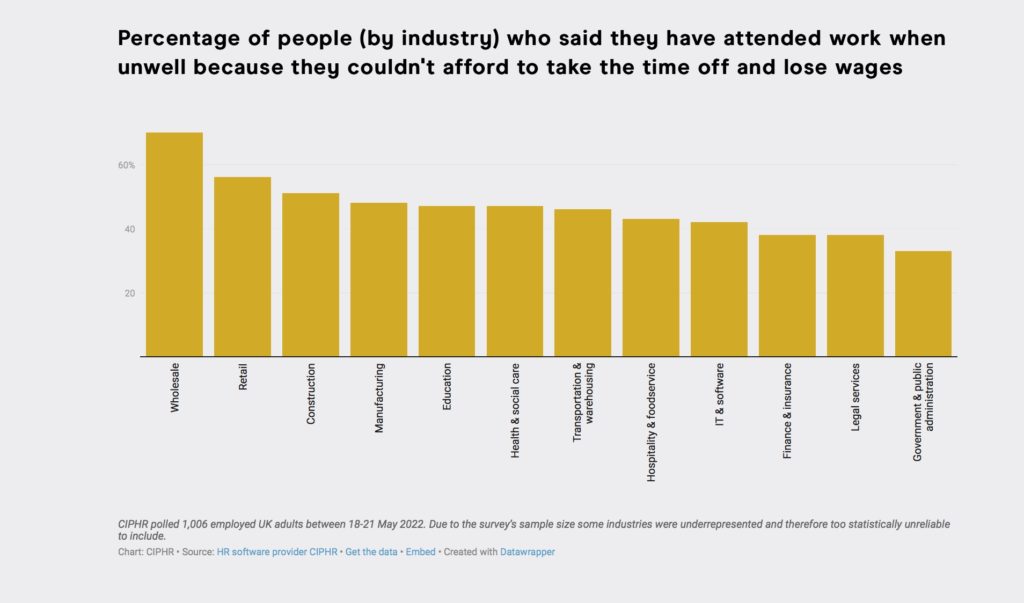

One worrying outcome of a cut in real annual salaries – where high inflation reduces the value of wages and pushes up the cost of living – is that people may start forcing themselves to work even when they are too ill to do so because they simply can’t afford not to. Shockingly, that’s the potential reality for nearly half (46%) of survey respondents over the last few months; and worryingly it’s even higher for low-wage workers.

ATTENDING WORK WHILE SICK

Over half (56%) of individuals earning under £30,000, compared to 37% of those earning over £45,000, say they have attended work, despite being unwell, because they didn’t want to take the time off and have their salary docked. For employees that work at organisations that only pay in line with statutory sick pay (SSP) rules, it means they must be off work sick for three days unpaid before they qualify to receive it. In comparison, for those entitled to company or contractual sick pay, it’s often triggered from day one.

Analysis of the data suggests that the industries most likely to have staff attending work while sick are wholesale, retail and construction; (70%, 56% and 51% of employees in those sectors respectively). The numbers for manufacturing, education and health and social care are also high; (48%, 47% and 47%, respectively).

“Lower earners and part-time earners – who are often predominantly female – are particularly at a disadvantage under the current SSP system,” noted Claire Williams, Chief People Officer at CIPHR. “Compounded by the pressures of rising living costs, it’s inadvertently created a situation where more and more employees are forced to work when they may not be well enough to do so, due to the financial impact of taking time off.”

EMPLOYEE ASSISTANCE PROGRAMMES

Money and financial struggles “can be a huge stressor, and can, in turn, have an impact on an individual’s mental health and their ability to perform in their roles”, added Williams. “While there are many things outside of an employer’s control, organisations have a responsibility to support employees’ mental wellbeing in the same way they would when looking after their physical health and safety. There are several ways that this can be achieved. Firstly, check whether any of your existing employee benefits have financial wellbeing support included, as this is usually an area of support offered by employee assistance programmes (EAPs).

Employers should consider introducing other benefits to help employees right now, “such as access to discounted shopping sites, health cashback plans, or loan schemes covering travel or new technology purchases,” highlighted Williams. “It’s also important to focus on raising awareness about how much financial wellbeing matters to the wider employee experience. Cost of living increases are impacting everyone; but not everyone equally.”

Williams believes that running financial education sessions and sharing useful financial information and resources can help mitigate some of the effects. “Managers also need to be mindful that everyone’s situation is different, and managers themselves may need extra training so that they can effectively support their teams on a day-to-day basis,” she advised. “These are incredibly challenging times, and employers can’t ignore the financial pressures affecting many in their workforce.”

Click here for the full results of the survey.