With only eight years left to achieve UN Sustainable Development Goals, around half of CEOs globally say their sustainability efforts have been hampered due to the geopolitical environment. Furthermore, the majority believe they will miss their own targets unless they double the rate of carbon emissions reductions by 2030, revealed a new study.

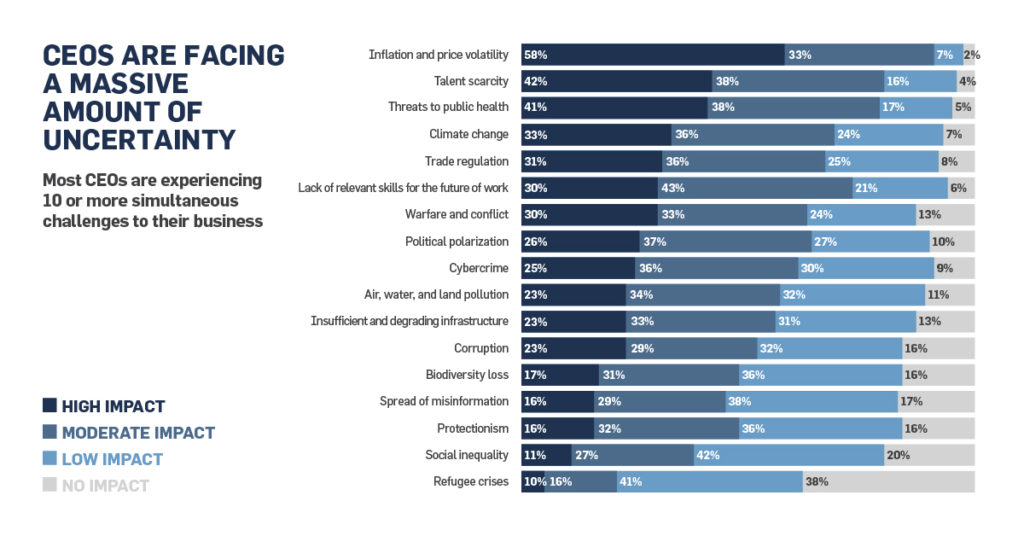

The 12th United Nations Global Compact-Accenture CEO study of more than 2,600 CEOs across 128 countries and 18 industries, reveals that CEOs globally are facing a massive amount of uncertainty. In fact, the vast majority (93%) are experiencing 10 or more simultaneous challenges to their businesses. Additionally, 87% are warning that current levels of disruption will limit delivery of the UN Sustainable Development Goals (SDGs), according to the study. While CEOs are increasingly concerned about these headwinds, nearly all (98%) agree that sustainability is core to their role; a sentiment that has grown 15 percentage points over the last 10 years of the study.

“In a world categorised by conflict, energy shortages, rising inflation and the threat of recession, this year’s study shows CEOs do not believe the world is as resilient to crises as we may have hoped. Businesses continue to be impacted by multiple shocks,” highlighted Sanda Ojiambo, Assistant Secretary General, CEO and Executive Director UN Global Compact. “As a result, on a broad range of issues, from runaway climate change to widening social and economic inequalities, business action right now does not match the ambition and pace needed to achieve the Sustainable Development Goals by 2030.”

ACHIEVING TARGETS BY 2030

As global challenges stack up, CEOs point to global issues that traditionally lie outside the corporate sphere – such as climate change or socio-political conflicts – as reasons for worry over-delivering value and impact for all stakeholders. With only eight years left to rescue the SDGs, nearly half (43%) of CEOs globally say their sustainability efforts have been hampered due to the geopolitical environment; with that number even higher for CEOs from developing countries (51%). When examining net zero targets set by the world’s largest companies, the study also found that nearly all will miss their own targets unless they double the rate of carbon emissions reductions by 2030.

As the halfway point to achieve the UN Sustainable Development Goals approaches and the deadline to meet key milestones of a 1.5C world looms, some CEOs are already taking action to avoid consequences to environment, society and business growth. Additionally, CEOs are continuing to make a great impact and showing clear pockets of success that deliver shared stakeholder value and competitive advantage in their industries; and eshaping the future of sustainable development through innovation and collaboration. For example, two-thirds of CEOs (66%) say their companies are engaging in long-term strategic partnerships to build resilience. These leaders are reconfiguring underlying supply chains, reskilling their workforces, reassessing their relationship with natural resources, and reimagining planetary boundaries through breakthroughs in technology spanning physical, digital and biological solutions.

RESILIENCE & GROWTH OPPORTUNITIES

“Not meeting the promise of the SDGs is a real concern but, at the same time, an enormous opportunity for companies that reinvent their enterprises and harness sustainability as one of the key forces of change in the next decade,” said Peter Lacy, Accenture’s Global Sustainability Services Lead and Chief Responsibility Officer. “CEOs are clearly concerned about resilience, but one leader’s resilience is another leader’s growth opportunity. New waves of technology investments and breakthrough innovation can put the SDGs back within reach – but only if leaders turn to sustainability for resilience to help create new markets, products and services that can correct the current trajectory and drive growth amid times of disruption.”

CEOs also identify a clear need to focus on technology for finding solutions to tackle global challenges and drive growth. Leading CEOs are already embedding sustainability into their businesses through launching new products and services for sustainability (63%), enhancing sustainability data collection across their value chains (55%) and investing in renewable energy sources (49%). Nearly half (49%) are transitioning to circular business models, and 40% are increasing R&D funding for sustainable innovation.

KEY INITIATIVES TO BUILD RESILIENCE

In interviews for the study, CEOs identified key initiatives to build resilience for companies, from establishing science-based climate targets and investing in their workforce’s diversity to engaging in cross-industry partnerships on technology solutions, enhancing supply chain visibility and advancing greater biodiversity. Additionally, CEOs continue calling for government engagement on policy changes that prioritise long-term measurable objectives as standardised ESG reporting frameworks; a global market for carbon and incentives for sustainable business models.

“Despite setbacks, there is room for hope,” concluded Ojiambo. “The CEOs we surveyed increasingly recognise they can build credibility and brand value by committing to the 10 Principles and the Sustainable Development Goals throughout their operations not only because it’s the right thing to do, but also because it is good business sense.”

Click here to access the 12th United Nations Global Compact-Accenture CEO Study.